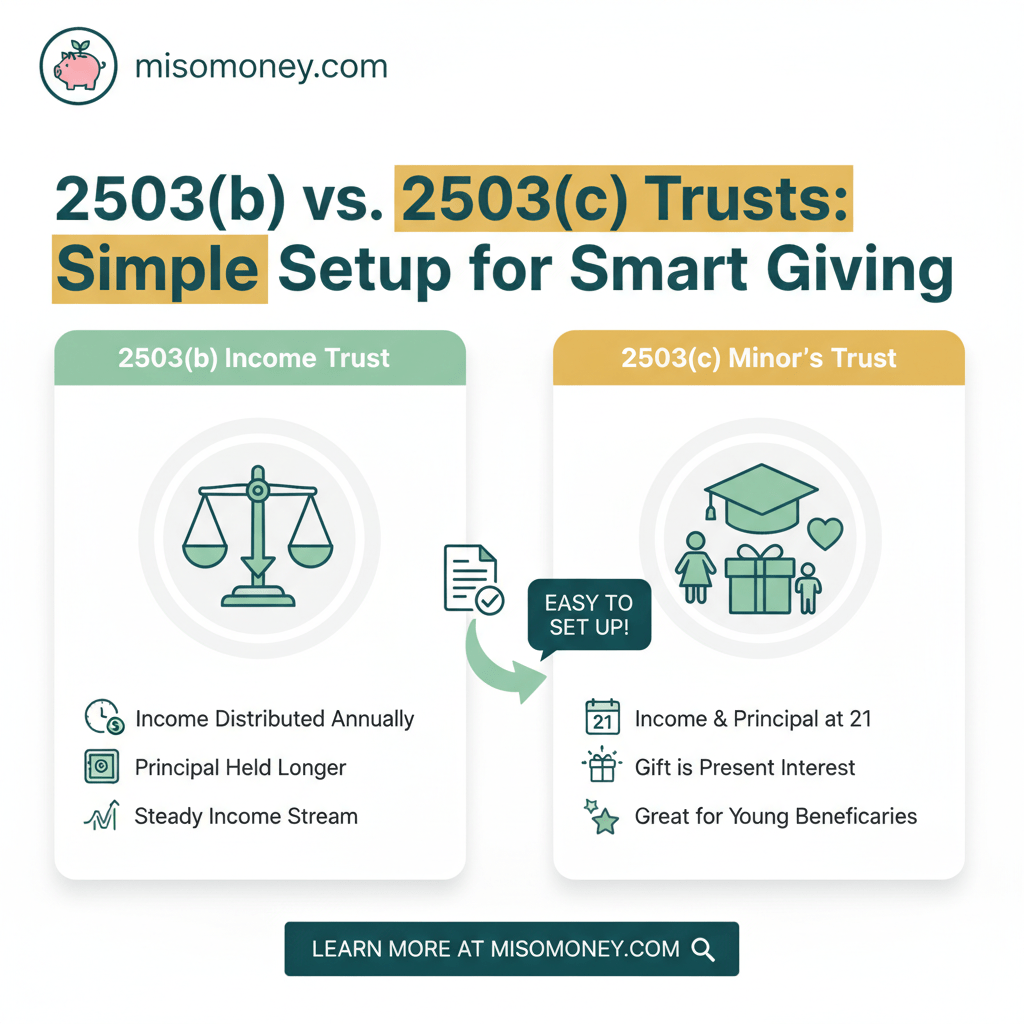

Welcome to MisoMoney! Today, we’re diving into the world of Section 2503 trusts – specifically, the difference between 2503(b) and 2503(c) trusts, and how surprisingly straightforward they can be to set up.

Understanding Gifting & Trusts: Why It Matters 🎁

Gifting is a powerful tool for wealth transfer, but the IRS has rules. Generally, gifts over a certain annual exclusion amount (which changes periodically, so always check!) are subject to gift tax. This is where Section 2503 trusts come in handy, allowing you to make significant gifts to minors while still qualifying for that annual exclusion.

The Lowdown on 2503(b) Trusts ⚖️

A 2503(b) trust, often called an “income trust,” allows you to make gifts that qualify for the annual gift tax exclusion. Here’s the key:

- Income Distribution: The income from the trust must be distributed to the beneficiary at least annually.

- Principal Access: The principal (the original assets) does not have to be distributed at any specific age. It can be held for the beneficiary’s lifetime or until a later specified age.

- Pros: Great for long-term wealth transfer where you want to provide a steady income stream for the beneficiary but retain control over the principal for a longer period.

- Cons: The beneficiary’s right to income is considered a “present interest” and qualifies for the annual exclusion, but the gift of the principal is a “future interest” and only qualifies for the exclusion if the present value of the income interest is greater than the annual exclusion. This can get a bit complex with actuarial tables.

Getting to Know 2503(c) Trusts 🎓

The 2503(c) trust, often called a “minor’s trust,” is specifically designed for gifts to beneficiaries under the age of 21.

- Principal & Income Access at 21: Both the principal and income must be available to the beneficiary at age 21. If they don’t take it then, the trust can continue, but they must have the option to take it.

- Present Interest: The entire gift – both income and principal – is considered a “present interest” and fully qualifies for the annual gift tax exclusion, making it simpler from a tax perspective.

- Pros: Straightforward way to make annual exclusion gifts to minors, with clear rules for qualification.

- Cons: The beneficiary gains full control over the assets at age 21, which might be earlier than some donors would prefer.

2503(b) vs. 2503(c): A Quick Comparison

| Feature | 2503(b) Trust (Income Trust) | 2503(c) Trust (Minor’s Trust) |

| Income | Must be distributed annually | Accumulates or distributes, available at 21 |

| Principal | Can be held beyond age 21 | Must be available to beneficiary at age 21 |

| Gift Tax Exclusion | Income interest qualifies, principal typically does not | Entire gift (income & principal) qualifies |

| Beneficiary Age | Any age | Beneficiary must be under 21 when gift is made |

| Complexity | More complex actuarial calculations for present interest | Simpler for annual exclusion qualification |

| Control | More grantor control over principal’s ultimate distribution | Beneficiary gains control at 21 |

Setting One Up: Easier Than You Think! ✨

Setting up either a 2503(b) or 2503(c) trust generally involves these steps:

- Consult an Attorney: This is crucial! A qualified estate planning attorney will help you understand which trust best fits your goals and draft the trust document correctly.

- Draft the Trust Document: This legal document outlines the terms, beneficiaries, trustees, and distribution rules.

- Fund the Trust: Transfer assets (cash, investments, property) into the trust. The trust becomes the legal owner of these assets.

- Appoint a Trustee: This individual or entity manages the trust assets according to the trust’s terms. It can be you (though there can be tax implications), another individual, or a corporate trustee.

- Obtain a Tax ID (EIN): The trust will need its own Employer Identification Number from the IRS for tax reporting purposes.

While the legal jargon might seem intimidating, the actual process, with proper guidance, is quite streamlined. Think of it as laying down a smart financial track for future generations!

MisoMoney’s Takeaway 🥢

Both 2503(b) and 2503(c) trusts are excellent vehicles for making tax-efficient gifts to younger beneficiaries. Your choice depends on your specific goals: do you want to provide a steady income stream while retaining long-term control over the principal, or are you comfortable with the beneficiary gaining full control at age 21 for a simpler tax exclusion?

No matter your choice, proactive planning with a legal professional is key. Happy gifting!

Disclaimer: This blog post is for informational purposes only and does not constitute legal or financial advice. Please consult with a qualified professional for personalized guidance.

Leave a comment